What To Expect From Revlon’s Q4 Results

Revlon (NYSE: REV) is slated to release its Q4 2017 results on March 9. The company will be eager to see a breakthrough in its results following a lukewarm performance over the last few quarters. However, driven by new initiatives in the second half of 2017, we expect the company to show some improvement in its results in the fourth quarter. Revlon has been doing better in its international markets than in the North American market of late, with its international growth primarily being driven by double digit growth in Asia and Latin America. Revlon’s Elizabeth Arden brand has also been performing well, with new launches and a strong digital presence. Driven by the Elizabeth Arden acquisition, the company is on track to attain integration synergies of $190 million by 2020, with significant synergies anticipated to be realized in fiscal 2017.

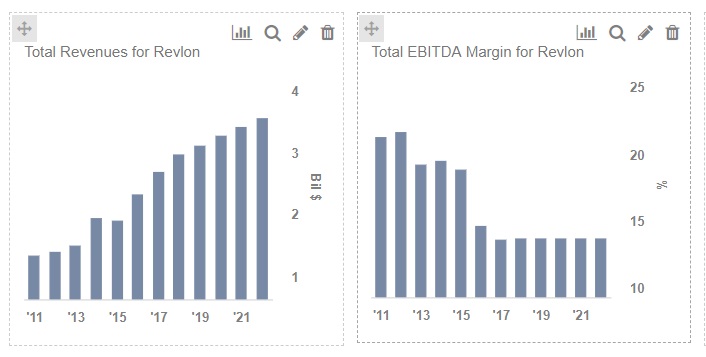

The company forecasts Q4 revenues of $785 million, below the $801 million from the prior year quarter but ahead of the analyst consensus estimate of $743 million. Full year 2017 net sales are estimated to be approximately $2.7 billion, compared to $2.3 billion in 2016.

Below we discuss key focus areas that will likely aid Revlon’s upcoming Q4 2017 results:

Focus on International Markets to boost sales – Revlon’s international business is likely to be one of the main driving factors for its business in the future. In the last quarter, the international sales improved by 5%. However, the company’s share of revenue from the U.S. market has been gradually declining. Consumers in the region have shifted loyalties to specialty beauty retailers or online purchases. However, the importance of this market for its business despite the negative trends is not lost on Revlon. The international business, on account of being more fragmented, leads to higher SG&A costs. Further, in a lot of international markets, sales take place through a distributor model, thereby lowering gross margins compared to the U.S.

Digital / Online Focus – Given the importance of digital progress and social media in a brand’s reach and popularity among its clientele (especially the younger ones), Revlon has started focusing on digital and e-commerce initiatives by setting up a new team of digital professionals. Along with increasing ad investments, the company is also shifting most of its campaigns to the digital platform. Revlon’s online sales grew impressively by 31% year-to-date through Q3 2017, and the company believes that online sales have tremendous potential for future growth, as right now it contributes to only 5% of overall revenues. Revlon collaborated with a leading digital consultancy, Sapient Razorfish, to create a stronger digital presence. These factors should positively impact results, as an increasing number of customers are buying beauty products online.

Overall, we expect Revlon to post improving results in its upcoming earnings.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.